The presiding judge is a hearing referee, a hearing officer (i.e., an administrative law judge), or a Tribunal member.įor more information regarding the filing of Stipulations for Entry of Consent Judgment, please review the Tribunal's Stipulation Tips Checklist. Non-property tax appeal hearings are held in the Tribunal's Lansing office. Property tax appeal hearings are held in the county in which the property is located or in an adjoining county. Click Notice of Hearing for a sample notice. See your Notice of Hearing for more information including the location, date, and time of your hearing. Small Claims hearings are generally 30 minutes in length.

There is no formal record taken of the hearing and parties typically represent themselves.

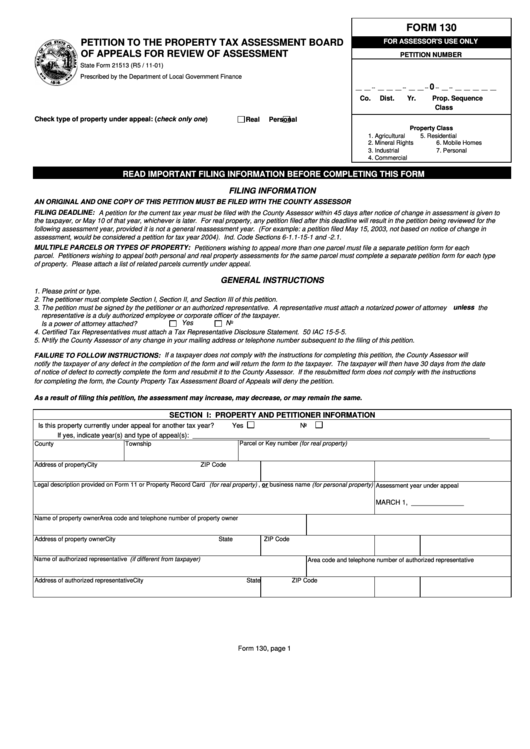

The Tribunal's Small Claims Division utilizes an informal hearing process to resolve the majority of all appeals filed with the Tribunal. For a speedier process, we encourage you to file your petition, answer, and other documentation through the Tribunal’s e-filing system. You may file the petition using the Tribunal’s e-filing system or by printing and mailing a completed petition form. Rather, you are required to file a petition to initiate a new Small Claims appeal. Effective March 1, 2013, the Tribunal is no longer able to accept Small Claims letter appeals.

0 kommentar(er)

0 kommentar(er)